reit dividend tax malaysia

Invest in Morningstar 4 and 5 Star Rated Funds. If 90 or more of its total income is distributed to unit holders a real estate investment trust in Malaysia will be exempt from income tax.

Pdf Benchmark For Reit Performance In Malaysia Using Hedonic Regression Model Semantic Scholar

19 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link.

. AMFIRST REAL ESTATE INVESTMENT TRUST. Simply put the rental income received by the company is not subject to corporate tax if. You still have to pay withholding tax.

However in the long run she continues to prefer the retail segment particularly prime or niche malls for their proven business resilience. If this 90 condition is not met the REIT would be subject to tax at the prevailing corporate income tax rate of 24. Meanwhile on Malaysian REITs still commanding attractive yields Yap says the high-yielding and Covid-19-resilient office REITS offer better interim gains via dividend yield compression.

REITs by the Capital Markets and Services Act 2007 for listing on Bursa Malaysia. However unit holders are liable to tax on the distribution of income. Malaysia has no WHT on dividends in addition to tax on the profits out of which the dividends are declared.

The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors. REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM 3. Yahoo Google Bursa Web TradingView.

REITs tend to pay out steady incomes similar to dividends which are derived from existing rents paid by tenants who occupy the REITs properties. Real Estate Investment Trusts. Interest on loans given to or guaranteed by the Malaysian government is exempt from tax.

Types of REITs A list of all 18 Malaysian REITs which are listed on Bursa Malaysia. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at least 90 of its total income to the unit holders during the year.

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Taxation and tax exemption of REITs in Malaysia. TTM Dividend Yield.

It is hope that the reduced withholding tax of 10 will be extended if not further reduced as in NIL withholding tax in Singapore in coming Budget 2011. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals. In a case where dividend income forms part of the total income distributed to unit holders the tax credit from tax at source is given to the REITPTF and the tax computation at REITPTF and.

Some treaties provide for a maximum WHT on dividends should Malaysia impose such a WHT in the future. ETF 2 MyETF MSCI Malaysia Islamic Dividend MyETF-MMID0824EA ETF 3 Principal FTSE ASEAN 40 Malaysia ETF CIMBA400822EA No Money Lahs Verdict. It has strong cornerstone investor which is Frasers Centrepoint Trust listed in Singapore.

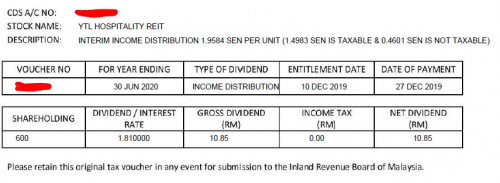

Axis REIT Managers Berhad Penthouse Menara Axis No. 48 rows YTL HOSPITALITY REIT. As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption.

2 Jalan 51A223 46100 Petaling Jaya Selangor Darul Ehsan Malaysia. 3Dividend distributions to an Australian branch of a foreign resident individual are not subject to withholding tax. No real authority or involvement over the management aspects.

All REITs seeking listing on Bursa Malaysia will require Securities Commissions approval under Section. If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment. Withholding tax of 10 or 25.

2 more Malaysia-listed ETFs that pay decent dividends. Ad Over 70 Morningstar 4 and 5 Star Rated Funds. Taxation of dividend income distributed by REIT in the hand of investors.

This exemption only applies to those listed on Bursa Malaysia. ARREIT has gearing of 4365 and involved in office building educational industrial hotels and. There is no capital gains tax regime in Malaysia for the sale of shares or marketable securities.

YTL Hospitality REIT the Trust is an income and growth type fund. High Dividend Yield. Otherwise the total income of the REITs will be taxed at the relevant rate of income.

Gearing is the highest as well at 442. Hektar is the first retail focused reit in Malaysia. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders.

Since the income distributed by REITs are tax exempt no tax credit under subsection 110 9A of the Income Tax Act ITA 1967. Another thing that you need to know about TradePlus MSCI Asia ex-Japan REITs Tracker.

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

How Are Individual Reit Holders Taxed Thannees Articles

What Are The Cons Of Investing In Reits In Malaysia

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

How Reit Regimes Are Doing In 2018 Ey Slovakia

How Are Individual Reit Holders Taxed

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Investment Tips Strategies For Malaysians Dividend Magic

Reits As A Less Stressful Option Pressreader

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Finance Malaysia Blogspot Understanding Reits

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

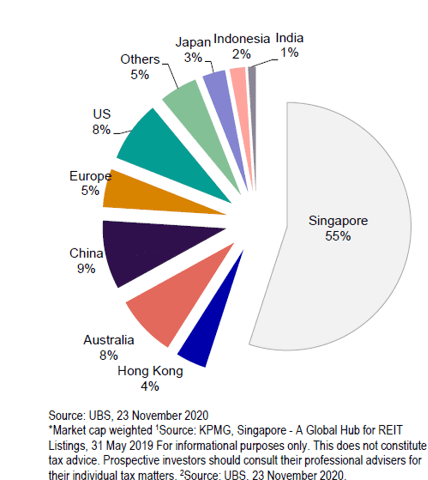

8 Things Every Investor Should Know About Asia Pacific Reits In 2021

Finke Is The Time Right For Reits Thinkadvisor

Performance Analysis For Malaysia Reits Aug 2005 Dec 2010 And Islamic Download Table

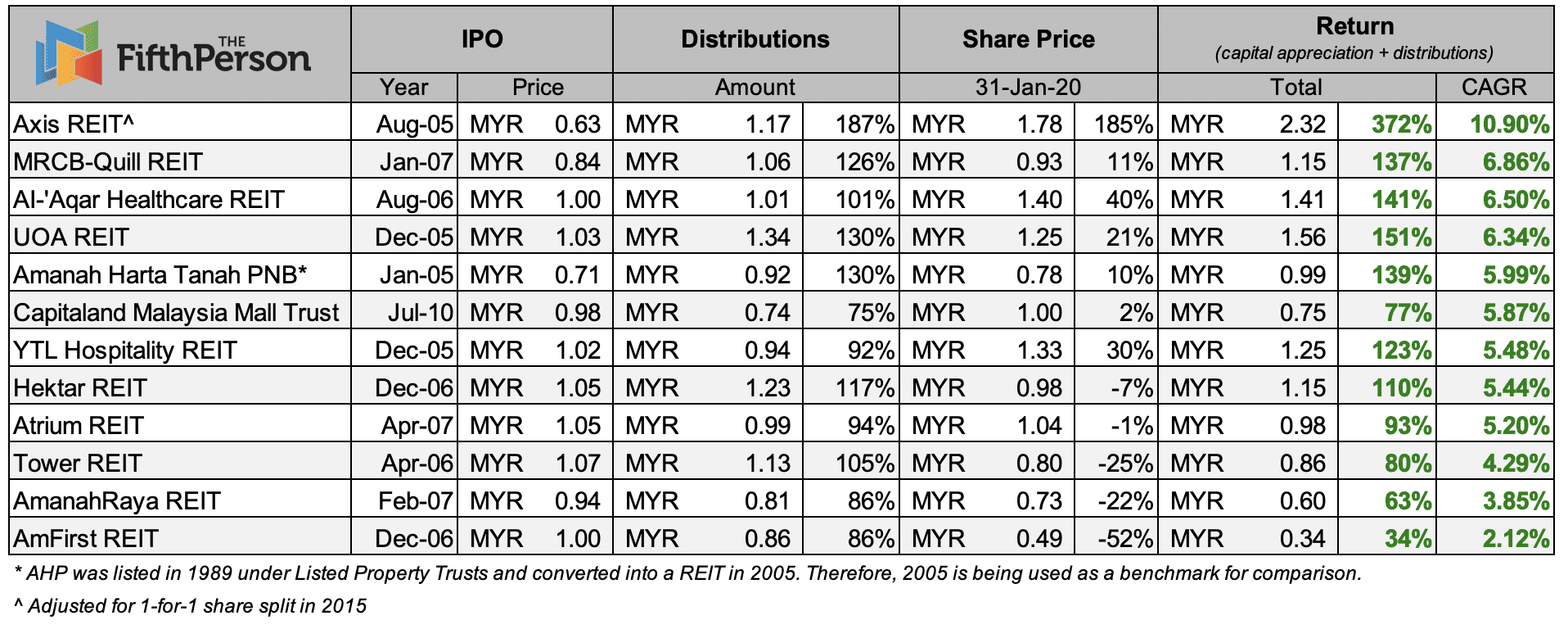

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos